Can Blockchain Solve Financial Inclusion?

Blockchain technology, which is often associated with cryptocurrencies, has the potential to solve many financial inclusion issues. It can help reduce the cost of transactions and allow for more secure and transparent global trading. This page tells https://cryptotrader.software/ it could help to increase profit while it reduces the amount of time of transactions, making it more accessible to those who are less able to access traditional financial systems.

However, there are some limitations to blockchain technology that you need to consider before widespread adoption. The technology could help reduce time-to-market for products and services targeting the underserved.

What is financial inclusion, and how can blockchain solve it?

Financial inclusion is making it possible for all individuals and businesses in a country to have access to basic financial services, such as loans, insurance, and savings. Financial inclusion is facilitated through traditional financial institutions or new technologies such as blockchain. Blockchain can help solve two major financial inclusion issues: transaction costs and trust. Transactions costs are the costs associated with using financial services.

It makes it possible for users to access financial products and services, including credit and banking. It is a challenge because many people excluded from the formal financial system lack access to traditional banking services or resources. This leaves them vulnerable to exploitation by criminals and corrupt officials.

Distributed ledger technology (DLT) is the solution to this problem. DLT can provide a secure and transparent platform for managing financial products and transactions. While financial inclusion has been a priority for the global community for many years, it remains a challenge.

It is important because it allows people to manage their finances, save for future needs, and invest in their businesses. However, it is also difficult to achieve because different parts of the world have different banking and payment systems that blockchain can solve.

What are the potential benefits of blockchain for financial inclusion?

Blockchain technology is a distributed database that allows secure, transparent, and tamper-proof recordkeeping. The potential benefits of blockchain for financial inclusion include:

- Reducing costs and increasing efficiency for financial institutions.

- Improving transparency and trust in financial systems.

- Facilitating cross-border payments.

While there are still some challenges to overcome, the potential benefits of blockchain for financial inclusion are worth exploring. There are many potential benefits of blockchain for financial inclusion. It could allow people in developing countries to access banking services.

Blockchain technology has the potential to revolutionise the way transactions are conducted online by making them the fastest. This could lead to improved financial inclusion for vulnerable populations, such as the unbanked and underbanked. Additionally, blockchain could help reduce fraud and corruption.

Limitations of Blockchain for Financial Inclusion

There are some limitations to blockchain’s potential for financial inclusion. First, it is not currently feasible to use blockchain in a cross-border context. Second, blockchain limits the number of transactions you can process per second. And the cost of implementing and maintaining a blockchain system is high. There is still a lack of clarity on how best to implement blockchain in the financial sector.

Blockchain technology on financial inclusion is still in its early stages and is not widely available. The blockchain system is not easy to use, and it requires a lot of trust in the network. It is difficult to scale up blockchain systems, making them difficult to use in large institutions. There are security concerns related to using blockchain systems for financial transactions.

Some of the limitations to blockchain’s potential for financial inclusion include its lack of widespread regulatory approval, scalability issues, and the need for a robust infrastructure. Additionally, blockchain is not well suited for cross-border transactions or complex financial products.

Final Words

The use of blockchain technology can help solve the financial inclusion problem. The technology provides a secure and transparent way for businesses to interact with each other, increasing the chances that these businesses will be able to provide financial services to those who need them most.

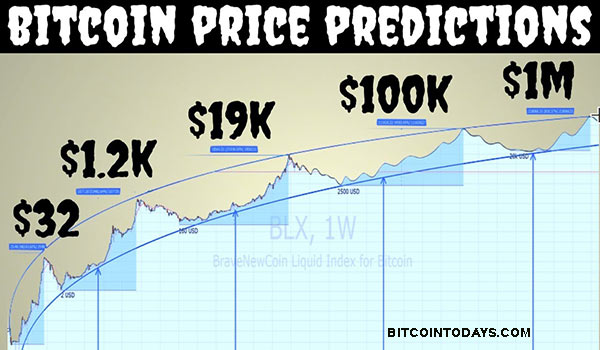

Many people are doing cryptocurrency trading to make huge profits. If you want to avail this opportunity, you should do cryptocurrency trading as many investors do. Blockchain could increase the number of people who have access to affordable financial products and services, which would be a major win for everyone involved.

Follow – https://bitcointodays.com for More Updates