Power of Bitcoin Fintechzoom: Reshaping Global Finance

What is Bitcoin Fintechzoom? Guide to Buying & Trading

Crypto and financial tech specialist makes useful Bitcoin Fintechzoom systems for better results. It is useful for access, faster work, and safe money deals.

Bitcoin Fintechzoom is a mix of Bitcoin and financial tech, bringing new ways for safe, clear, and fast money transaction. The start of Bitcoin Fintechzoom can be linked to those who first made up crypto.

It is very supportive and useful in the money tech world, making it cheaper and user-friendly. Bitcoin Fintechzoom pulls in both Bitcoin and Ethereum. It is helpful in clear ledgers, online coins, smart contracts, common rules, and asset tokens. Clear ledgers, like blockchain, show all money deals and help to keep them safe and right.

Common rules, like Proof-of-Work and Proof-of-Stake, make trust with math between groups, so they don’t need a boss or middleman. This keeps money work clear and safe. Asset tokens let lots of things be put on the web and make new ways to invest. This part of Bitcoin Fintechzoom helps to make new, smart money work.

The Startup of Bitcoin Fintechzoom

The history of Bitcoin Fintechzoom can be years of ago, which initially started by tech enthusiasts and visionaries. As the fintech industry advanced, it used for financial services, making them more cost-effective and user-friendly.

It is mixed of two words Bitcoin and Fintechzoom, offering new way for managing financial services by secure, transparent, and efficient tech.

Decoding the Essence of Bitcoin Fintechzoom

The Bitcoin Fintechzoom represents the fusion of cryptocurrencies like Bitcoin and Ethereum with cutting-edge financial technologies. It is useful in outdated financial systems and takes benefits of decentralized ledgers, digital currencies, smart contracts, and asset tokenization.

Decentralized Ledgers

Decentralized ledgers, such as blockchain, provide a transparent and important record of transactions; this technology ensures that financial data is secure, verifiable and accountability in financial dealings.

Digital Currencies

Digital currencies, like Bitcoin and Ethereum, enable peer-to-peer transactions that are programmable and resistant to censorship, it is easy money transfers without reducing costs and increasing efficiency.

Smart Contracts

Smart contracts, a core component of Bitcoin Fintechzoom, utilize for programming to understand the logic to complex business transactions. These contracts remove the need for mediators, reform methods and reducing costs.

Consensus Protocols

Consensus protocols, such as Proof-of-Work (PoW) and Proof-of-Stake (PoS), establish mathematical trust between parties, reducing the need for centralized authorities or mediators. This decentralized approach enhances security and transparency in financial transactions.

Tokenization: Digitally Representing Assets

Tokenization allows for the digital representation of various assets, diversifying ownership forms and enabling new investment opportunities. This feature of Bitcoin Fintechzoom opens up avenues for new financial goods and services.

Bitcoin Fintechzoom Disrupting the Traditional Financial System

Bitcoin Fintechzoom is a digital currency that gives a new way to traditional financial systems while providing new solutions to make financial transactions faster and safer for everyone. It is being adopted in many areas around the world.

Financial inclusion

The most relevant effect caused by Bitcoin Fintechzoom regarding financial inclusion lies in the democratization of access to financial services. Since it disrupts and decentralizes the entire financial system, removing the control from few outdated financial institutions, it provides the new methods to join in the digital economy.

Safety and clarity

The use of cryptographic methods to secure data in circulated ledgers. It protects users against fraud and increases transparency and legality of all transactions related to the digital currency. This contributes to a safer financial environment and increases general trust in the system.

Same day settlement

Gone are the days of multi-day clearance and payment delay. Bitcoin Fintechzoom uses spread agreement to ensure that each transaction is uniquely identified and recorded on the ledger instantly.

Disintermediation and reduction of costs

Bitcoin Fintechzoom reduces costs by removing the need for mediators and by optimizing costly back-office processes such as clearance, settlement and reporting, thus financial services to a larger number of users.

Navigating Regulatory and Compliance Challenges

As Bitcoin Fintechzoom becomes more integrated into mainstream finance, it encounters its fair share of regulatory challenges. Regulated entities are working on establishing standards that strike a balance between innovation and consumer protection, much like the regulatory frameworks in traditional finance.

Bitcoin Fintechzoom in Action

Even though it’s still in its early stages, Bitcoin Fintechzoom has already made significant strides in revolutionizing the financial landscape with its pioneering platforms and applications.

Ripple: Changing the Game in Global Payments

Ripple’s RippleNet, a blockchain-based infrastructure, is transforming international payment systems for financial institutions. It enables real-time settlement, drastically reducing the time and costs associated with worldwide transactions. RippleNet connects hundreds of banks and payment providers across more than 50 countries, making global commerce more seamless.

Ethereum: The Trailblazer of Decentralized Finance (DeFi)

Ethereum has been at the forefront of revolutionizing finance through the use of smart contracts on its blockchain, giving rise to decentralized finance (DeFi). This sector encompasses applications that offer services like trading, and insurance, all operating independently of central financial authorities. With DeFi, Ethereum’s protocols manage financial transactions using unalterable code, showcasing Bitcoin Fintechzoom’s extensive capabilities in reshaping market frameworks.

Key Components of Bitcoin Fintechzoom

Bitcoin Fintechzoom encompasses a diverse range of applications and services that leverage blockchain technology and digital currencies to reinvent financial management. These include:

Digital Wallets and Payment Systems

Digital wallets and payment systems are fundamental aspects of Bitcoin Fintechzoom, allowing for the secure storage, transfer, and management of cryptocurrencies like Bitcoin and Ethereum. These systems make transactions more efficient and affordable, with lower fees and faster processing times compared to traditional banking systems.

Decentralized Finance (DeFi) Platforms

At the forefront of Bitcoin Fintechzoom are DeFi platforms that empower users to lend, borrow, insure, and trade assets without the involvement of intermediaries. These platforms utilize blockchain technology to ensure privacy, security, and freedom in financial transactions, opening up new possibilities for financial inclusion.

Asset Management and Investment Solutions

Bitcoin Fintechzoom has revolutionized asset management and investment practices. Through tokenization, physical assets can be seamlessly transferred, attracting new investors looking for diversification and potential returns. Additionally, these platforms offer tools like trading, portfolios, and yield farming to help users maximize their investment returns.

Enhancing Financial Inclusion

One of Bitcoin Fintechzoom’s core strengths lies in its ability to enhance financial inclusion. By eliminating the need for traditional banking institutions, financial services become accessible to individuals and communities who were previously underserved. This democratization of finance empowers people and fosters global economic growth.

Transactional Security and Immutability

Bitcoin Fintechzoom leverages blockchain technology to ensure the security and immutability of financial transactions. Transactions recorded on the blockchain are secure, publicly verifiable, and resistant to tampering, reducing the risk of fraud and promoting accountability in financial dealings.

Facilitating Real-Time Cross-Border Transactions

Traditional worldwide transactions often involve lengthy processing times and high fees. However, with Bitcoin Fintechzoom, real-time or near-real-time transactions are facilitated, streamlining global financial movements and enhancing the efficiency of international business operations.

Challenges and Considerations in Bitcoin Fintechzoom

Hey there! So, Bitcoin Fintechzoom has a ton of opportunities, but it’s not all smooth sailing. Let’s talk about some challenges and things to consider:

Regulatory Uncertainty and Ambiguity

One big challenge for Bitcoin Fintechzoom platforms is the lack of clear regulations from governments. They still haven’t figured out how to handle digital currencies and blockchain-based services. This uncertainty can really hold back innovation, investment, and adoption.

Vulnerability to Hacking and Data Breaches

Okay, so the secret nature of blockchain and the fact that transactions can’t be changed makes it a potential target for hackers. That’s why Bitcoin Fintechzoom platforms need to have super strong security measures in place, like encryption, multi-factor authentication, cold storage, and regular security audits. Keep those user assets and data safe from the bad guys!

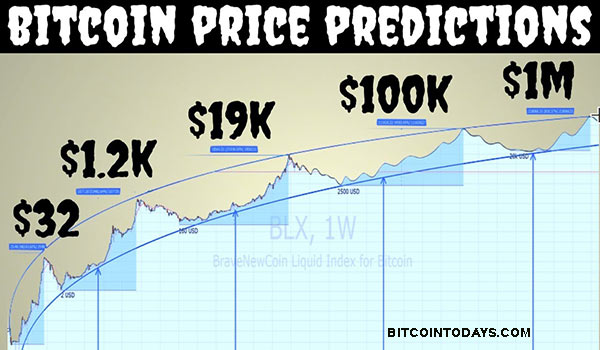

Cryptocurrency Volatility and Investment Risks

You know how cryptocurrencies can be all over the place in terms of their value, right? That volatility can be risky for investors and businesses. Prices can change like crazy, which means you can either make a ton of money or lose a bunch. That’s why it’s important to carefully assess the risks and diversify your investment portfolio.

Scalability and Transaction Speed Limitations

Sometimes, when there’s a lot of activity on a blockchain network, things can get slow and expensive. Transaction fees go up, and it takes longer to process transactions.

Not the best user experience, right? But don’t worry, specialist are working on it. They’re trying to develop layer-two protocols and improve blockchain scalability to fix these technical challenges.

The Future Outlook of Bitcoin Fintechzoom

Despite the challenges, the future looks bright for Fintechzoom. It’s gaining popularity thanks to new advancements in blockchain technology, clearer regulations, and better security measures.

And get this: even traditional banks are starting to use blockchain technology and digital currencies. That means Bitcoin Fintechzoom could become a normal part of the financial world!

As Fintechzoom keeps growing up, it’s gonna have a major impact on finance. It’ll make things more inclusive, efficient, and secure. Imagine a financial system that works for everyone!

Conclusion

There has no doubt Bitcoin Fintechzoom is changing the game in global finance. With cryptocurrencies, blockchain tech, and awesome financial innovations, it’s revolutionizing how we do transactions. It’s all about making things easier, safer, and more transparent.

Sure, there are challenges along the way. But the potential for financial inclusion, cost savings, and real-time worldwide transactions is driving Bitcoin Fintechzoom’s growth. By embracing its transformative power, we’re paving the way for a better, more inclusive and secure financial future.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or investment advice. Always do your own research and consult with a professional advisor before making any investment decisions.

Follow – https://bitcointodays.com for More Updates